Economic Fundamentals: The Forgotten Depression

Have you ever heard of the other Depression of the 1920s? Sure, you've heard of the Great Depression that started under Hoover in 1929. But have you heard about the one that started under Wilson in 1921?

The Depression of 1920/21

The 1929 depression was characterized by double digit unemployment. The 1920/21 depression was also characterized by double digit unemployment. According to historian Burt Folsom, the 1920/21 meltdown "had economists excited over what was shaping up to be one of the worst crises in American history."

Come again?

Folsom says the end of the Wilson administration was characterized by massive unemployment as troops returned from the Great War (World War I). In 1918, the armed forces employed 2.9 million. By 1920, 320 thousand were in the armed forces. Unemployment reached 12% and was a huge issue in the presidential election.

Mismanagement at the Federal Reserve compounded problems. The Fed raised interest rates from 4% at the end of 1919 to 7% six months later. This choked off credit needed by businesses and consumers at a time when the labor force was swelling with returning veterans.

The economy contracted 6.9%, technically making the contraction a sharp recession and not a depression (a 10% contraction is necessary for a depression). Prices fell by 18% in a single year. Wholesale prices feel by 37%. Automobile production dropped 60%. Overall industrial production fell by 30%.

Technically, 1920/21 may not have been a depression, but it felt like one. Between the end of 1919 and the middle of 1921, the Dow fell 47%. The rate of business failures tripled and solvent businesses experienced a 75% decline in profitability.

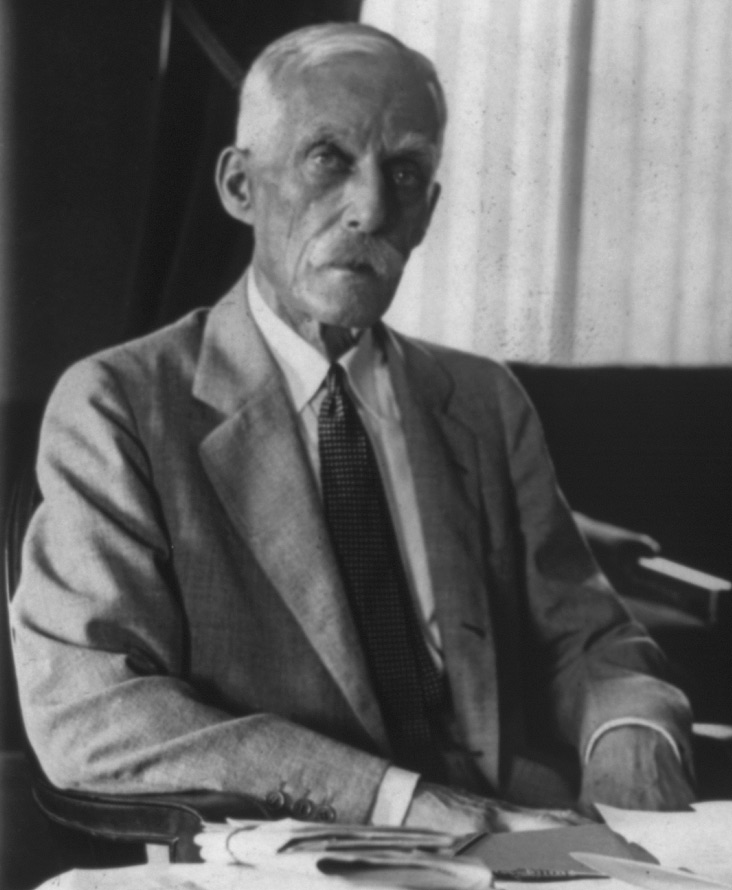

Promising a "return to normalcy," Warren G. Harding was swept into office by a 60% to 34% landslide with Calvin Coolidge as his vice president. Half way through his term, Harding died from a heart attack and Coolidge was sworn in as president. Coolidge, one of the country's greatest and most overlooked presidents, continued Harding's economic policies seamlessly.

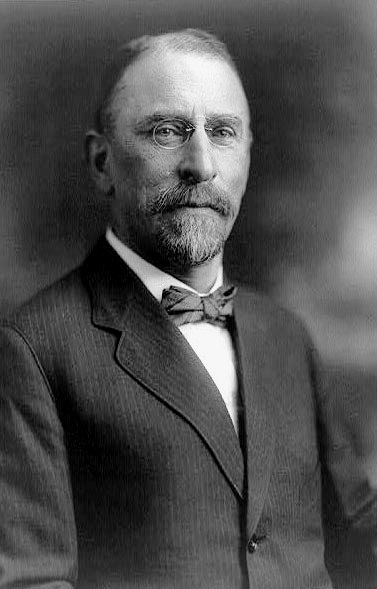

Harding's Secretary of Commerce was Herbert Hoover. Hoover pushed Harding to "do something." So Harding held a President's Conference on Unemployment. All of the brightest minds of industry, academia, and government were involved. Collectively, they urged Harding to engage in a massive stimulus program, putting unemployed vets to work on infrastructure projects, such as roads and bridges.

Harding's response? He said the spending would require massive tax increases that would cripple the economy. Instead, Harding did the opposite. He cut taxes and spending, which Coolidge continued after Harding's death.

Harding cut the top income tax rate from 73% to 25%. With better after tax returns, entrepreneurs were willing to risk their capital. If an entrepreneur risked and lost, he lost it all. If he risked and won with a 73% marginal rate, he could only keep 27% of his profit. When the rate lowered to 25%, he could keep 75%. Suddenly, more people were willing to take a chance.

Someone who wasn't taking much of a chance was Harding. As Treasury Secretary, Andrew Mellon said, "Seventy-three percent of nothing is nothing. Twenty-five percent of something is something."

Harding coupled the tax rate reductions with cuts in federal spending. Folsom reports that Harding wanted to keep the U.S. competitive globally and attract investment.

If you think that cutting government spending and tax rates is a recipe for massive deficits, guess again. The economy boomed as entrepreneurial activity was released. Overall tax receipts went from $700 million in 20/21 to over $1 billion by 28/29. The government ran surpluses, cutting 1/3rd of the national debt.

During Coolidge's term as president, unemployment averaged 3.3%. According to Folsom, at the end of his presidency, unemployment was 1%. Since inflation was 1%, Coolidge averaged a misery index (inflation + unemployment) of 4.3%, which half any other 20th century president.

The Great Depression

The 1920s depression you've probably heard about is the one that commenced under Hoover and was continued under Roosevelt. Hoover, if you recall, was one of the people who wanted to enact a stimulus program during the earlier depression. In private, Coolidge called Hoover, "wonder boy" and once remarked that, "He's been giving me advice for six years, all of it bad."

In school I learned that the Great Depression was started by the 1929 market crash, which was a failure of capitalism and free markets. The mythology is that Hoover did nothing. He sat back in callous disregard for the plight of the public. If only.

In reality, the Depression didn't start with the stock market crash. In fact, the markets had started to recover. From mid November, 1929 to April, the Dow recouped half the decline from the peak and was nearly level with the prior year.

Milton Friedman, the greatest economist of the 20th century, advanced the belief that the Fed's contraction of the money supply (and increase in rates) kick started the Great Depression. Others blame the Smoot-Hawley tariff. Still others, credit a combination.

Smoot-Hawley was the largest tariff increase in U.S. history. The merits of free trade is one area with almost no disagreement among economists. Over 1,000 economists sent Hoover a petition urging a veto. Industrialist pleaded with him personally to veto the bill.

Hoover didn't listen. He signed Smoot-Hawley into law, raising tariffs on over 20,000 products, launching retaliatory tariffs around the world. The bill artificially raised prices on products made more competitively overseas. This led other countries to artificially raise the price of products we produced more competitively, killing our exports. Exports fell 27% in 1930, 36% in 1931, and 34% in 1932 (Source).

Next, Hoover launched his infrastructure stimulus program. To pay for it, he raised top marginal income tax rates from 25% to 63%. Unemployment soared to 25% in 1932.

Roosevelt entered the picture promising tax cuts and federal spending cuts. The party platform called for spending cuts of 25%. If Roosevelt would have kept his promises, the depression might have soon ended. He didn't and it didn't.

Roosevelt didn't like or trust entrepreneurs (the feeling was mutual). Rather than turn to business people for solutions to the economic problems Roosevelt assembled a "brain trust" of college professors. Yikes!

Folsom described the academic solutions. Farm exports were down, resulting in surplus production, and falling prices. The brain trust's solution? Pay farmers not to produce.

The farmers thought getting paid not to produce was a fine idea, but actually idling good farmland seemed kind of silly. So they cheated.

To stop the cheating, the government hired inspectors to physically check on the farms. So the farmers bribed the inspectors and kept on cheating.

In response, the government hired inspectors to check on the inspectors. When this didn't work because the inspectors split the bribes, aerial photography was deployed with auditors studying aerial photographs.

The Feds were determined and eventually, the U.S. did develop farm shortages. By 1935 we were importing cotton, corn, and wheat because farmers weren't producing enough. Some of the shortfall was due to the 1930's era global warming and the Dust Bowl. Still, it was absolutely ludicrous that we were paying farmers not to farm, importing farm products at a premium, and paying a legion of bureaucrats to oversee the entire mess. As Folsom says, this was only one government program and not even the worst.

We had government sponsored price fixing. Business owners were told what they should charge and literally tossed in jail if they didn't charge enough.

Roosevelt started massive government programs left and right. New regulations and taxes arose in a kind of government schizophrenia that froze business investment out of uncertainty. We saw the creation of gas taxes, tire taxes, telephone taxes, telegram taxes, movie ticket taxes, and on and on.

Roosevelt boosted income tax rates to 79%. Later he even tried to hike the top marginal rate to 99.5%. When Congress resisted, he issued an executive order instituting a 100% income tax on all income over $25,000. Congress repealed this to 90%, which stayed in place until the Kennedy tax cuts in the early 1960s.

The tax and spend stimulus worked so well that U.S. unemployment was still at 19% in 1938, compared to 11% for the rest of the world. The Secretary of the Treasury, Henry Morgenthau, declared privately, "We have tried spending. We are spending more than we ever spent before and it does not work. We have never made good on our promises. I say that after eight years of this administration we have just as much unemployment as when we started and an enormous debt to boot."

The 1920s had two depressions. Harding and Coolidge fought one with low taxes and reduced spending to create an environment ripe for entrpreneurial stimulus. The result was a rapid end to the depression and one of the most prosperous decades in history. Harding and Coolidge were so successful that we don't even remember the depression they confronted.

The second depression was addressed by higher taxes across the board, massive government stimulus, tremendous government debt, and increased regulation that created an environment of uncertainty and froze entrepreneurial activity. Hoover and Roosevelt deepened and expanded the 1929 depression, turning it into the Great Depression.

Listen to the following address to a group of college students by Burt Folsom, where he compares and contrasts the economic policies and outcomes of Harding/Coolidge with Hoover/Roosevelt.

Why We Won't Repeat the Hoover/Roosevelt Experience

The comparisons between today and the Great Depression are eerie. The increased taxes, increased regulations, and protectionist trade measures are especially concerning. The business climate is clouded with uncertainty about government policies. However, it is unlikely that we will repeat the dismal performance of the 1930s for the following reasons...

1. Experience

In the 1930s, we had not experienced full blown Keynesian economics. Today, we have. Moreover, we've had the counter experience of the Kennedy Tax Cuts and Reagan Tax Cuts (not to mention, Harding's). We've felt the impact of Keynesian policies during the Nixon and Carter administrations. We've seen the impact on Japan with their "Lost Decade." While there are still committed Keynesians, they can no longer tout theory without opposition and without ignoring facts and history (though most will try).

2. Entrepreneurial Velocity

The world moves faster today than the 1930s. Businesses and entrepeneurs are simply faster than the slow, heavy hand of government. Think of a river, flowing in its channel. While it's possible to stop the flow by erecting a dam, the river will eventually overflow the dam unless released through a spillway.

The economic dams of government are eventually breached as the Soviet and Chinese experiences revealed. And in the U.S., the government isn't damming up the entrepreneurial river. It's merely tossing large boulders in the path of the river, which flows around or over the obstructions.

3. Information

During the Great Depression, information flow was centralized and limited to newspaper and radio. Roosevelt had an easy time using the bully pulpit of the presidency to dominate the information flow of the airwaves and used the power of the IRS to intimidate the press. Today, traditional media has become curiously incurious and monolithic. It's also rapidly becoming irrelevant as information is decentralized.

4. Taxes

It's simply impossible to imagine any politician advocating and the public accepting the confiscatory tax policies of the Roosevelt era. People forget that the top marginal rate was 90% in 1963! Kennedy brought it down to 70%, where it largely remained until Reagan. While Congress and the administration will foolishly allow the Bush tax cuts to expire next year, there's no returning to the high taxes of the past.

One area of concern is corporate taxes. Only stagnant Japan has higher corporate tax rates. Add state taxes and the U.S. has the world's least competitive corporate tax rates. High rates drive business and investment to countries offering higher after tax returns. As a nation, we need to get corporate taxes in line with the rest of the world.

Another concern is the recent discussion about a Value-Added Tax (VAT), unless it replaces the income tax. VATs are consumption taxes like the sales tax, only built into pricing and hidden from view. Based on the European experience, VATs tend to ratchet up whenever politicians are forced to prioritize. Carbon taxes, by the way, are also consumption taxes that are hidden from view.

5. The American Public

The populace is better educated and informed today. It is unlikely the public would allow government officials to tinker with their lives over a protracted period like the 1930s. Patience is thin and the voters are likely to return the country to divided government if the economy stagnates.

6. American Entrepeneurs

Personally, I have too much faith in American entrepreneurial ability and all levels. Despite attacks on business and the denigration of profitability by the media, government, and academia, the U.S. remains an entrepreneurial bastion. People are too creative, too resiliant, and too self-reliant to be suppressed. We will succeed in spite of government interference.

Still, imagine what would have happened if the TARP and stimulus funds had been passed along to the public in the form of reduced income, capital gains, and corporate taxes. I have to believe the recession would have ended in a heartbeat and we would be approaching full employment instead of cresting double digit unemployment.

As individuals, we can't control the government and should not let it control us. While it's up to each of us to be vigilant and to influence the governing class the best we can, we cannot forget that we control our own destinies. It is up to each of us to take all necessary steps to chart our own courses. History proves that we can succeed.

During the Great Depression, many companies prospered. They were the companies who acted as though there was no contraction. They aggressively sought new business and took it from their more timid competitors. Advertising executive, Dave Chase, describes what happened:

Generally speaking, those companies that not only survived but also thrived during the Great Depression were those that continued to act as though there were nothing wrong and that the public had money to spend. In other words, they advertised. These are industries that didn't wait for public demand for their products to rise. They created that demand even during the most difficult of times.

Because so many companies cut spending during the Great Depression era, advertising budgets were largely eliminated in many industries. Not only did spending decline, but some companies actually dropped out of public sight because of short-sighted decisions made about spending money to keep a high profile. Advertising cutbacks caused many customers to feel abandoned. They associated the brands that cut back on advertising with a lack of staying power. This not only drove customers to more aggressive competitors, but it also caused financial mistrust when it came to making additional investments in the no-longer-visible companies.

Both anecdotal and empirical evidence support the case that advertising was the main factor in the growth or downfall of companies during the Great Depression. To put it bluntly, the companies that demonstrated the most growth and that rang up the most sales were those that advertised heavily.

During every recessions many prosperous new businesses are created as well. Hyatt, Burger King, IHOP, the Jim Henson Company, LexisNexis, FedEx, Microsoft, CNN, MTV, Trader Joe's, Wikipedia, Sports Illustrated, and GE were all started during recessions (source). These companies started with no revenue during bad times and still prospered.

History has much to teach us if we'll study it. It shows that the American entreprenurial spirit is overwhelmingly powerful when supported and remains impossible to suppress when not supported. Don't let anyone suppress your spirit. Get out there and make something happen!

If Keynesian and Neoclassical economics get under your skin, check out this journal from Adbusters: https://www.adbusters.org/cultureshop/backissues/85

ReplyDeleteA nice, meticulous laid out argument Matt!

A very quick impression. It's raining. Everyone is outside running around in the rain crying,"it's raining!" Those with spirit whip out their umbrella, not letting the rain inhibit one second of their day.

And to continue, those folks with umbrellas are getting a lot more stuff done, read: business is good, than those running around in circles whining about the rain.